Portfolio management

Portfolio management is the part of strategic planning process where a company considers how best to allocate its limited resources (i.e. its management time, effort, assets and cash) between its various business activities. These include its:

Portfolio management is the part of strategic planning process where a company considers how best to allocate its limited resources (i.e. its management time, effort, assets and cash) between its various business activities. These include its:

- Products and services

- Customer segments

- Route to market trade channels

- Geographical territories

The objective of portfolio management is to determine the optimum allocation of resources that will create most value for investors defined as the net present value of a company’s future free cash flows discounted by its average weighted cost of capital. Learn more about what value is, how it is measured and how it is created and destroyed in the article entitled Shareholder Value Explained.

The first stage of portfolio management is to undertake a strategic position assessment. There are two commonly used analytical tools that facilitate this. These are:

- The growth share matrix developed by the Boston Consulting Group (BCG) known as the Boston matrix

- The market attractiveness company position screen developed McKinsey & Co for General Electric known as the McKinsey matrix

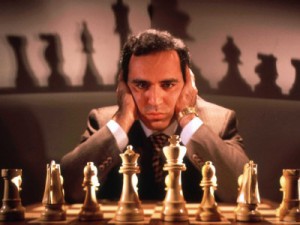

Analytical tools such as the Boston and McKinsey matrices provide powerful insights that help guide boards and managers to take well-informed portfolio resource allocation decisions. However, ultimately, portfolio management requires skill, wisdom and judgment. And as with chess, there is a big difference between knowing how to move the pieces and being a Grandmaster.

Analytical tools such as the Boston and McKinsey matrices provide powerful insights that help guide boards and managers to take well-informed portfolio resource allocation decisions. However, ultimately, portfolio management requires skill, wisdom and judgment. And as with chess, there is a big difference between knowing how to move the pieces and being a Grandmaster.

Some do’s

- Focus on core activities and invest to build ability to compete

- Clear out the clutter – complexity distracts and comes at a cost

- Remember what made you successful

- If competitive position is weak, focus on a small segment of the market with a highly differentiated superior customer value offering

- Seek expert professional advise

Some don’ts

- Compete head on from a weak competitive position

- Be seduced to enter fast growing markets unless you can be an early entrant and or deliver superior customer value

- Spread the jam too thinly

- Put all your eggs in one basket – instead stay focused

To discuss your business critical issue

Please call Paul New on 020 8390 9972 or 07790 501225 or send a message.